For installers and contractors the new york state energy research and development authority nyserda currently offers a rebate for pv systems for residential sites in any region 25kw or less.

New york state solar power rebate.

Guidance on determining federal and or new york state tax credit eligibility.

Next comes the new york solar tax credit of 25 of costs up to 5 000.

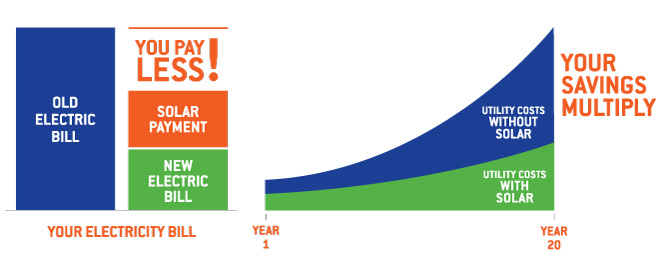

That reduces your cost after the first year to only 8 485.

The second most important incentive for solar panel installations in new york is the state solar tax credit which allows you to potentially earn an extra 5 000 to put towards your taxes on top of the federal solar tax credit.

The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5 000.

After the tax credits we subtract your first year s energy savings which we estimate to be 1 483.

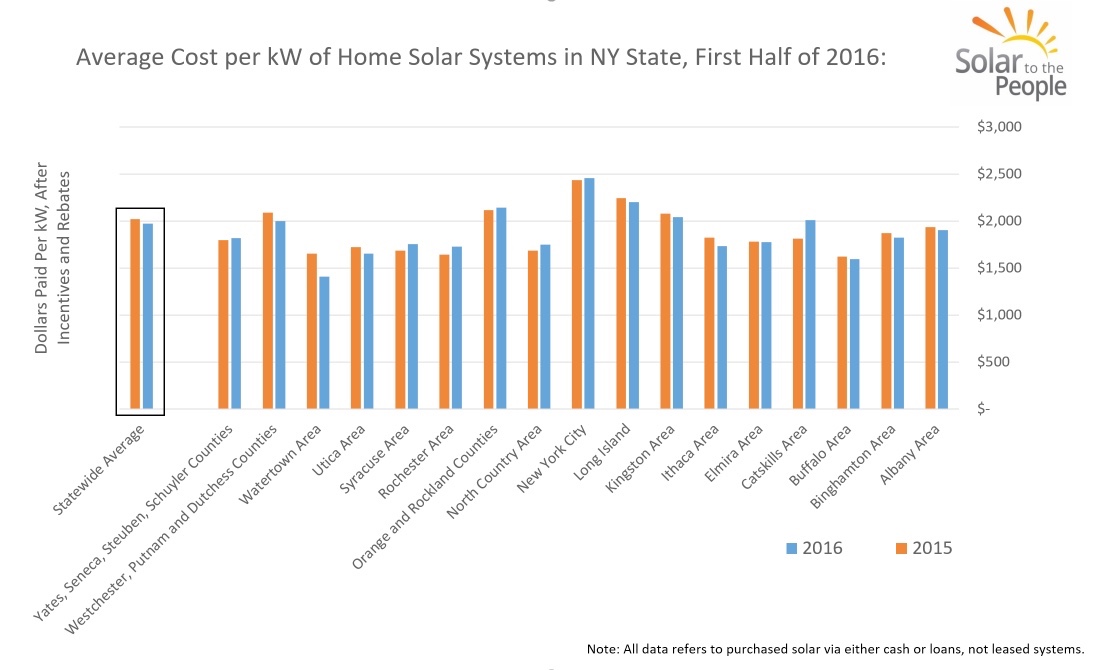

As of september 2020 the average solar panel cost in new york is 2 91 w given a solar panel system size of 5 kilowatts kw an average solar installation in new york ranges in cost from 12 368 to 16 732 with the average gross price for solar in new york coming in at 14 550 after accounting for the 26 federal investment tax credit itc and other state and local solar incentives the.

New york s megawatt block incentive is a direct generous incentive for solar energy available under new york s ambitious ny sun initiative.

Solar incentive and financing options.

Ny sun pv incentive program.

The program provides an up front dollars per watt w rebate for both commercial and residential solar panel systems.

New york s residential solar tax credit is equal to 5 000 or 25 percent of the cost of your solar system whichever is less.

If your property isn t ideal for solar panels or you are not a homeowner community solar may be right for you.

Eligible costs include labor on site assembling and installing the system and the cost of all related piping and wiring.

In addition to incentives ny sun offers two loan options for residents.

Detailed information on available incentives and loans for residential customers going solar.

The solar energy system equipment credit is not refundable.

Loan amounts are available from 1 500 to 25 000 with loan terms of five 10 or 15 years to help new york residents finance solar installation.

How much is the credit.

At the federal level under the residential renewable energy tax credit taxpayers can claim up to 26 of qualified expenses for investing in a solar system for a home you own and live in.

The size of your subsidy depends on how much solar energy is already being produced in your area and could be as high as 1 w.

The megawatt block incentive structure.

New york state tax credit.

New york residential solar tax credit a similar tax credit is available at the state level for systems up to 25 kilowatts in capacity.

.JPG)